Few people outside the infrastructure sector are familiar with Teamv. However, this São Paulo-based family group is set to invest over R $ 80 billion in projects in the upcoming years, surpassing the plans of well-known companies like Ecorodovias, Environmental BRK, Iguá Sanitation, and even Motiva (formerly CCR).

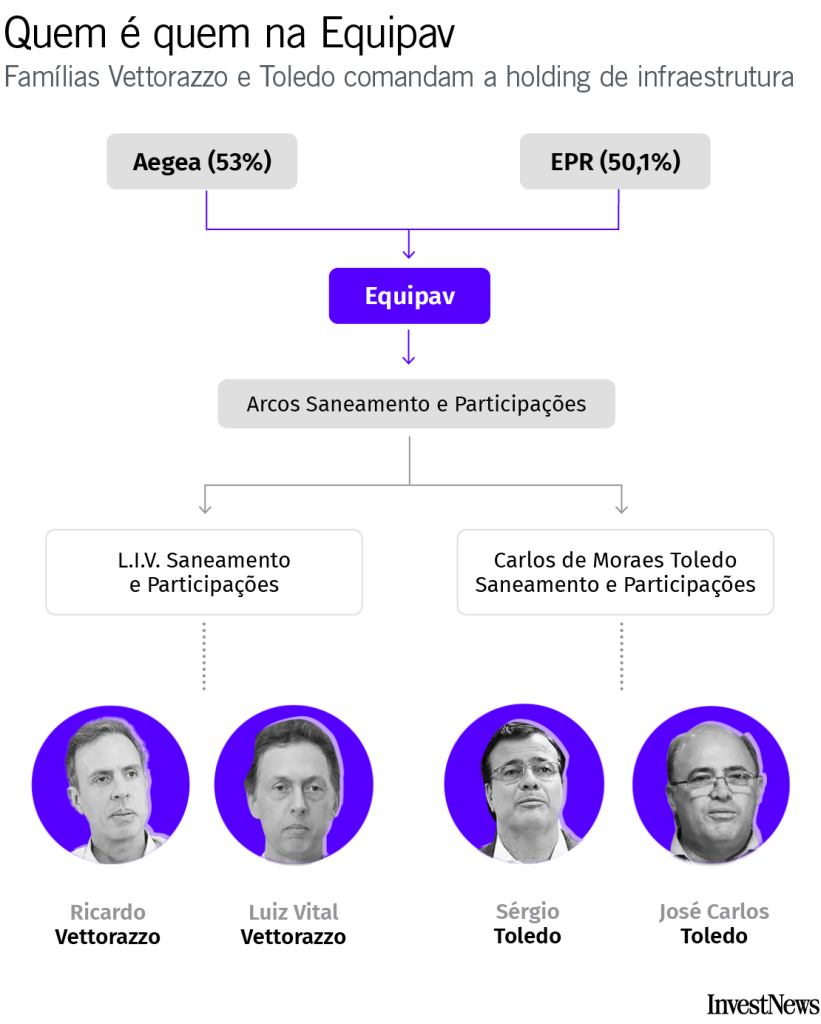

Today, Teamv has united Aegea, a top private sector leader in basic sanitation, and EPR, which has secured six road concessions since 2022. This partnership combines key players, focuses family capital, and is designed for competitive auctions and complex projects. Germina Brasil, within the group, focuses on irrigation agriculture projects.

Equip, established 65 years ago, has recently transformed significantly by shifting from a regional builder to a platform with two capital-intensive infrastructure branches. Last year, the company incurred a loss exceeding R $ 16 billion, while generating a net profit of R $ 1.45 billion and distributing over R $ 300 million in dividends to the controlling families, Toledo and Vettorazzo.

“In 2010, they faced significant challenges and intense pressure but managed to overcome them through hard work,” according to a source familiar with the situation.

From roads to waste management

The “Pav” in the name Equip is not just for show: the company originated in 1960 in Campinas (SP) as a road pavement construction firm founded by three families with a background in cane production.

It has expanded its operations to include concrete production and large infrastructure projects, maintaining a low-key regional presence. The company’s focus shifted to infrastructure projects in the mid-2000s after selling its cement business to the Camargo Corrêa group.

Equip joined forces with Bertin in the agricultural sector to establish Cibe Participações, a holding company focused on sanitation, highways, and energy, which acquired water and sewage concessions and various road projects.

The plan caused the 2008 crisis and financial collapse of Bertin. The finance division couldn’t support it, leading to divestments and restructuring to lower debts. By 2010, disagreements and financial stress resulted in a separation.

The alliance with Bertin and the Tarallo family was dissolved in the new setup. The Toledo and Vettorazzo families continued as partners, focusing on sanitation, which became the core of the company Aegea. Bertin acquired highway concessions, while the Tarallo family exited the partnership. This marked the transition from Cibe to the present structure of Teamv as an infrastructure holding firm.

The split was difficult, but ultimately it worked out for those who remained. Bertin was successful initially, but later faced setbacks. The team was left with the most valuable asset, which allowed them to expand, a source remembers.

Over ten years later, both families continue to be in control. Sérgio de Moraes Toledo and José Carlos de Moraes Toledo lead the Toledo family, while Luís Vital Vettorazzo and Ricardo Vettorazzo are actively involved in managing and making strategic decisions for the Vettorazzo family.

“They are family entrepreneurs who excel in forming strong partnerships and have the ability to collaborate with strategic allies as needed. The leadership, represented by Luiz Vettorazzo and Sérgio Toledo, is known for being approachable and easily accessible.”

Teamv developed the platform that currently oversees two of the nation’s most focused investment firms within this family structure.

Aegea: the importance of clean hygiene

Hamilton Amadeo spearheaded Aegea’s early growth in the 2010s, championing professionalization and overseeing initial concessions before departing in 2023. Radamés Casseb, trained within the company, took over leadership, ensuring a seamless transition that upholds the organization’s familial culture.

Amadeo’s departure did not change the trajectory. Equiv attracted new financial backers for expansion, including Itaúsa, the Setúbal family, a major shareholder of Itaú, and Singapore’s sovereign wealth fund (GIC).

Under Casseb’s leadership, Aegea maintained the momentum that established it as the top private sanitation company. Currently, it serves 33 million individuals across 766 cities in 15 states and oversees contracts totaling R $ 45 billion in investments scheduled through 2033.

These initiatives have positioned Aegea as a leading investor in the sector, surpassing prominent competitors such as BRK and Iguá, and establishing Teamv’s sanitation division as one of the largest private ongoing projects in the country.

In the second quarter of 2025, Aegea’s net profit was R$ 295.5 million, a decrease of 8.7% compared to the previous year. The net operating revenue increased by 26.4% to R$ 1.86 billion due to the addition of new contracts and tariff revisions.

The Ebitda increased by 27.7% to R$ 1.03 billion, representing a margin of 55.5%. The total net debt amounted to R$ 16.4 billion, equivalent to 3.9 times the adjusted Ebitda over the past year.

The roads of EPR

Aegea handles sanitation, while the EPR, a partnership between Teamv and Perfin, focuses on road infrastructure.

Established in 2022, EPR gained prominence by winning six concessions and securing almost R$ 38 billion in investments within two years. Led by experienced executive José Carlos Cassaniga, the operation progressed systematically.

Contracts consist of significant federal and state benefits, like plots in Paraná and projects in Minas Gerais (including the BR-040 highway between Belo Horizonte and Juiz de Fora), positioning EPR competitively against established companies such as Motiva (formerly CCR) and Ecorodovia in terms of the value of projected undertakings.

In the first quarter of 2025, EPR reported a net profit of R$ 65.9 million, bouncing back from a loss of R$ 21.5 million in the previous year. Operating revenue increased to R$ 1.02 billion, boosted by new concessions and tariff adjustments.

The Ebitda increased by 84.9% to R$ 594.1 million, with a margin of 58.3%. The net debt stood at R$ 8.5 billion, leading to a leverage of 3.5 times the adjusted Ebitda over 12 months.

The appropriate timing

Equip started in sanitation when new laws allowed the sector to open up, and then moved into heavy highways when federal auctions resumed.

Now that they have a complete range of projects, the task is to carry them out and maintain the growth momentum that has led the Vettorazzo and Toledo families to this point. Those familiar with their journey recognize their eagerness for new ventures and ability to bounce back from challenges. Despite facing tough times, they have prospered and are now reaping the rewards of their hard work.

InvestNews searched for Teamv but they did not provide an interview.